How do you avoid cryptocurrency scams? The easiest way is just to stay at home and don’t play with your hard-earned cash. But if you’re determined to invest in the somewhat risky world of cryptocurrency, there are a few common scams you should be aware of.

As with any scam, being caught out is going to hit you hard. We don’t want that. Here are five common scams to watch out for.

1. Shady or Insecure Exchanges

The explosive popularity of Bitcoin and other altcoins has seen a huge rise in cryptocurrency exchanges. They all want your attention and, more significantly, the transaction fees that come with handling your purchases.

However, there aren’t many completely trustworthy cryptocurrency exchanges. Popular exchanges have been known to completely disappear overnight, taking all the cryptocurrency with them.

If you’re entirely new to cryptocurrency, you might not have heard of Mt. Gox. This was an early cryptocurrency exchange that at one point accounted for over 70 percent of all Bitcoin transactions worldwide. One morning in February 2014, Mt. Gox suspended trading. It later surfaced that 850,000 Bitcoins had been stolen (valued at $ 450 million at the time, over $ 3.5 billion as of this writing) and remains one of the world’s worst cryptocurrency hacks.

A Short List of Somewhat Trusted Exchanges

I’m not one to spread FUD without offering you some good news: there are some excellent exchanges out there. I hold a number of altcoins myself, and I’ve never had any trouble with any exchange listed below. Of course, this is all subjective, but my experiences are relatively uniform with other cryptocurrency enthusiasts.

- Coinbase: Support for Bitcoin, Ethereum, and Litecoin.

- Kraken: Support for Bitcoin, Ethereum, Litecoin, Monero, and other popular altcoins. Some smaller altcoins too, such as Augur, and Stellar Lumens.

- Bittrex: Support for almost every coin you can think of, and more you’ve never heard of. The only drawback is the company’s notoriously slow customer service.

- Cryptopia: Support for a ridiculously large number of coins, also features an extremely low transaction fee.

Remember, do your own due diligence before placing any amount of Bitcoin or altcoins on an exchange.

My final tip is to not keep your cryptocurrency stored on an exchange. Transfer those coins to an offline wallet at the end of the day—it only takes a short amount of time to send them back to an exchange for trading. If you’re going to really get into cryptocurrency, consider upgrading to a cryptocurrency hardware wallet.

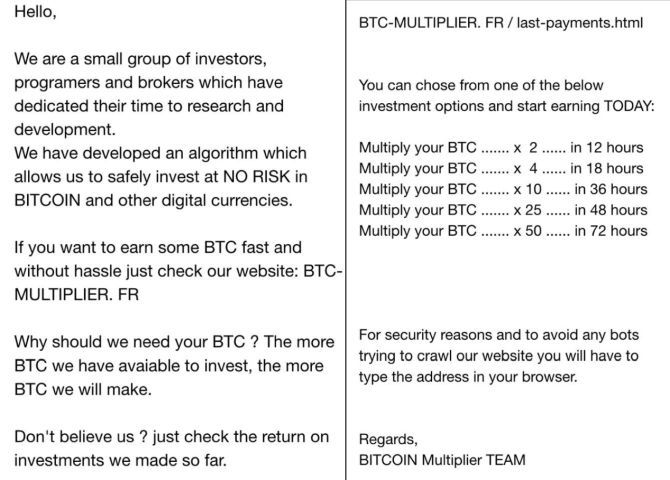

2. Pyramid and Ponzi Schemes

In the spring of 2017, a Mumbai-based company called OneCoin was delivering a sales pitch to a room of investors. Indian financial enforcement officers raided the meeting, ultimately jailing 18 OneCoin representatives for operating a cryptocurrency Ponzi scheme. At the time of their arrest, OneCoin had already moved over $ 350 million through a payment processor.

Investors had been duped through a combination of enthusiastic upselling, lack of knowledge of the technology in front of them, and a lot of positive media coverage (of both the project and booming cryptocurrency prices). A lot of people lost a lot of money.

We like to think we’re clever enough to spot a scam when it’s in front of us. But cryptocurrency is creating new scams, using jargon and technology most people have never heard of, let alone truly understand. Even grasping the basics of blockchain technology and smart contracts is difficult for the layman.

3. Pump and Dump Schemes

Many prominent financial experts have also dismissed cryptocurrency as a scam. While some compare Bitcoin to other safe haven investments, such as gold, others believe it is merely a speculator’s heaven, ripe for pumping and dumping.

Bitcoin has a market capitalization of over $ 110 billion at the time of writing. It would be very difficult to directly manipulate the price. But smaller altcoins are extremely vulnerable to a standard pump and dump.

In many ways, the thousands of smaller altcoins have taken the place of penny stocks, albeit with a technological edge. Furthermore, there are several groups dedicated to this exact practice. They hold a monthly vote to choose an altcoin with a tiny market capitalization, and descend.

4. Initial Coin Offerings

Initial Coin Offerings (ICOs) are the IPOs of the cryptocurrency world. Cryptocurrency startups create initial coin offerings to raise substantial amounts of money. However, many of them vastly overestimate the value of their startup. Others are simply elaborate pump and dump schemes.

The Securities and Exchanges Commission (SEC) is extremely wary of ICOs. It offers the following warnings:

- There is often a lack of accurate or current information about a coin.

- Questions often arise concerning the accuracy of publicly available information, including press releases and media coverage.

- There are questionable trading practices, such as insider trading, market manipulation, and more.

Of course, this doesn’t actually always protect potential investors from scam ICOs, as we saw earlier with OneCoin. Due to the market hysteria surrounding ICOs, and the potential for large short-term profits, many scammers are attempting to profit. Alternatively, companies announce their ICO before the technology is truly ready.

Note: Learn more about the SEC’s stance on ICOs.

The DAO

When The DAO (a decentralized autonomous organization named for the acronym) completed their 2016 ICO, raising over $ 34 million, experts hailed it as a success. That was until some users exploited a vulnerability in the DAO code, and siphoned one-third of The DAO’s funds to another account. To return the funds to the original account, the Ethereum community had to agree to a hard fork, tearing the cryptocurrency in half.

DAO is now delisted from major exchanges and is seen as a major factor in the (much needed) close scrutiny of the SEC in cryptocurrency ICOs.

Not All ICOs Are Bad

Again, I don’t want to spread FUD without giving some really positive ICO information.

For example, Filecoin raised over $ 200 million for their decentralized storage system based on blockchain technology. Filecoin had some seriously impressive backers, too, including Winklevoss Capital (owned by the Winklevoss twins), Sequoia Capital, and Andreessen Horowitz.

There are also a number of very promising ICOs on the horizon—but as we have just seen, it’s difficult to know exactly what to trust without considerable research.

ICO Ban

ICOs have also made the (cryptocurrency) news after both China and South Korea took steps to ban them. According to Reuters, The South Korean Financial Services Commission said that institutions and individuals conducting business relating to an ICO “stern penalties.”

This move comes after the Chinese government banned all ICOs, calling them “illegal fundraising.” China is also worried about the power cryptocurrency gives its citizens. Decentralized anonymous currency in the form of ICOs (and other altcoins) could easily “disrupt their social order.” China has previously banned Bitcoin and cryptocurrency related activity, each time causing a slump in global markets.

5. Some Coins Don’t Actually Exist

In August 2017, the City of London Police shut down a “cryptocurrency business” that was cold-calling people to sell fake digital currency. Victims were cold-called and persuaded to purchase non-existent cryptocurrencies. Nine victims came forward to the UK firm, Action Fraud, with combined losses exceeding £150,000.

The man who allegedly set up the scam used a central London address, in the financial center, to lend the scam authenticity.

Real investors will not cold-call you to offer an opportunity, cryptocurrency or not. If you receive a call asking for your investment in a project, note the name of the caller, the company name and address, and put the phone down. Your next call should be to the SEC to report potential securities fraud.

Impersonators

A growing threat comes from social media. Prominent cryptocurrency company accounts are being impersonated on Twitter and Facebook. The scam pages directly contact individuals, asking for investment in their project, or to buy discounted Bitcoin or Ethereum. The addresses provided belong to the scammers.

Is Cryptocurrency Bad?

No. Far from it.

But any burgeoning technology will attract unscrupulous individuals—especially if that technology involves anonymity and can lead to high returns.

The key to staying safe in cryptocurrency is research. There are always unfortunate individuals that take the plunge and will fall victim to fraud. Things that seem too good to be true probably are. Some cryptocurrency day traders do make vast amounts of money—but they know what they’re doing. And many of them have trading, buying, and selling Bitcoin and other altcoins since the very early days of cryptocurrency.

Remember, start small, and only invest what you can afford to lose.

Image Credit: Krivosheevv/Depositphotos

Read the full article: 5 Common Cryptocurrency Scams and How to Avoid Them